Rushing McCarl LLP just filed an amicus brief in the United States Court of Appeals for the Fifth Circuit on behalf of ClientEarth and The Shareholder Commons in a consequential case implicating shareholders’ voting and oversight rights.

The case, National Center for Public Policy Research v. SEC (5th Cir. Case No. 23-60230), concerns shareholders’ rights under SEC rule 14a-8. That rule requires companies to include shareholder proposals in the proxy materials that they send to shareholders. Intervenor National Association of Manufacturers (NAM) seek to remove shareholders’ right to include proposals in proxy statements distributed before annual shareholders’ meetings and transfer control of proxy statements to company managers. But company directors and officers are fiduciaries who manage companies on behalf of their owners — that is, shareholders — and often have different incentives than shareholders. Managers’ earnings are often tied to short-term growth in one company, while shareholders are concerned about their savings and retirement accounts across their entire portfolio of investments.

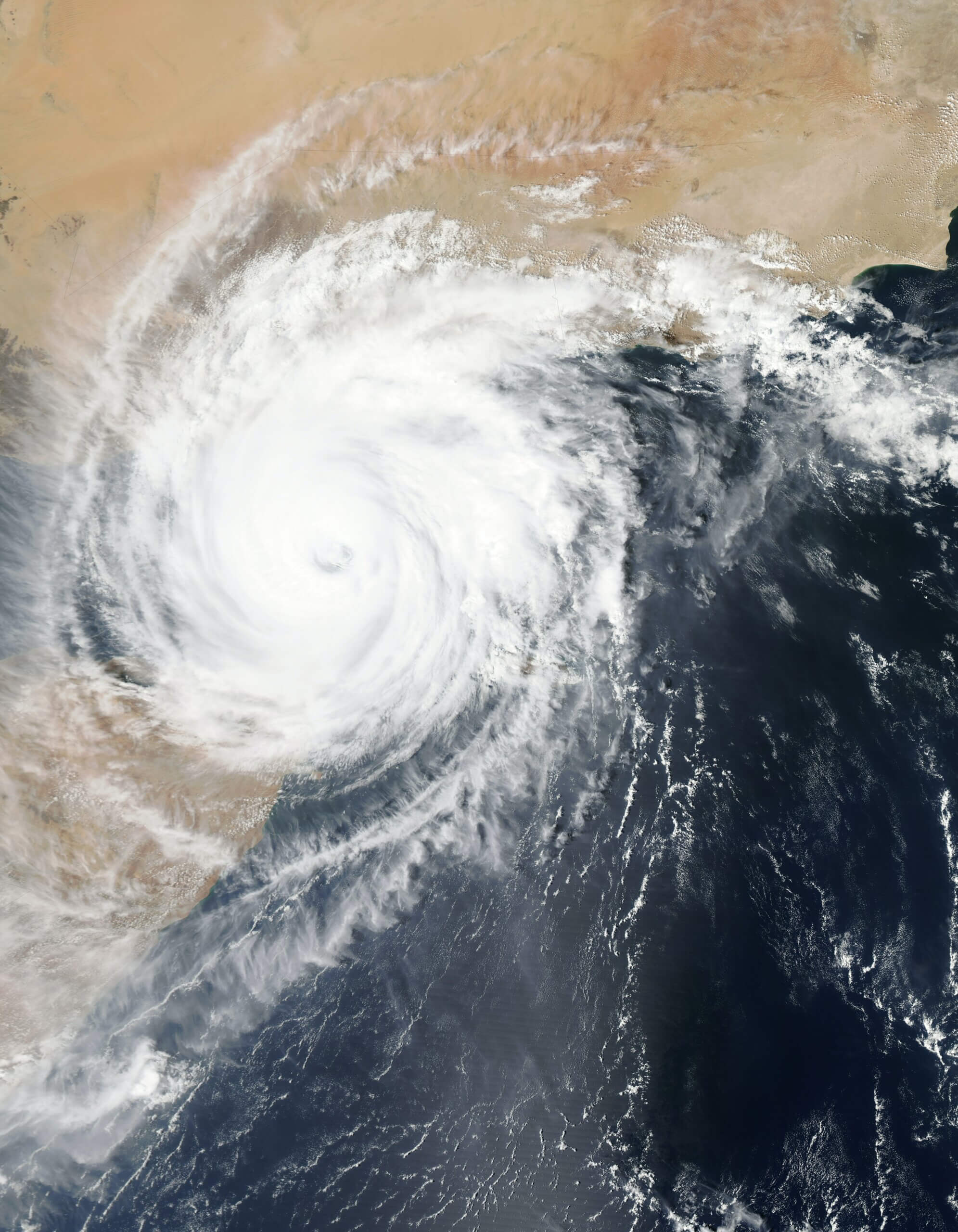

NAM aims to allow company managers to exclude shareholder proposals related to environmental, social, and governance (“ESG”) matters, which it portrays as irrelevant to financial considerations. On the contrary, even setting aside the fact that many investors care about the environment and are concerned about climate change for non-financial reasons, shareholders also have a purely financial interest in monitoring how companies respond to environmental risks such as those posed by climate change. Such risks may include liability and regulatory risks, insurance risks, and risks to supply chains, among others. Rushing McCarl’s clients therefore reject the premise that ESG matters are unrelated to shareholder value, as these matters directly affect company success and the economy as a whole.

Climate change will dramatically affect global markets, consumers, governments, and businesses. Shareholders will have to bear the costs relating to these economic disruptions, and existing securities regulations give them a right to propose resolutions intended to ensure that companies are prepared to address these risks. Businesses that are ill-equipped to respond to changes in the physical environment — not to mention the regulatory and insurance “environment” — expose shareholders and the broader economy to substantial risk. Shareholders should be allowed to use their voting and oversight rights to ensure the companies in which they invest take appropriate precautions.